Today’s crazy stock market

Buying stocks is a dice roll because of the constant change in stock values.

April 12, 2021

If you invested in stocks and think they’re doing well, better check again. Stocks in 2021 have been extremely unpredictable. Investors across the U.S. are asking the same question. What is causing the change in the stock market? By answering this question, many interested investors can gain more insight into how to make better investment decisions.

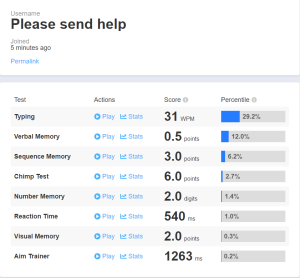

One of the biggest mistakes investors make is basing their decisions only on the stock index. The stock index is a good way to view if prices have increased or decreased in the past, but many people do not understand that the stock index does not show the full market picture. Typically, each stock is weighted differently depending on the market size. The stock with the bigger weight will have a bigger effect on the index value. A good example of the top 10 weighted stocks areAmazon, Apple, Microsoft, Facebook, Exxon, Google and similar large companies. This list is 20 percent of the entire stock index. If these stocks do well, everything looks as it should. But as of Sept. 15, 2020, the prices of about 61% of stocks were positive. That means other than 39% of stocks were down until the biggest drop of 121.5%. This split between positive and negative stocks has been historically true and it is virtually impossible to tell which stocks will gain more percentage.

The only reason people invest in a company is that they believe that it will make them future profit. If the company stock rises, the person makes money. If it falls, they lose money. The drive for the anticipated stock prices can vary. For some companies, the goal is to get higher earnings, which is how companies measure their portions or profit. For smaller companies, especially tech companies, the main focus would be growth. Future losses in the stock market may not matter if the companies customer base and revenue continue to increase. If the U.S. economy is down, but people are sure that a stock’s price will continue increasing, the share price will continue to rise.

The stock market is always changing, meaning that people with higher social status such as politicians can affect the market. An example of this is the central banks. Right now, the central banks have a bigger impact than large politicians. As many central banks tried unsuccessfully to increase growth, two things happened: it made bonds less attractive (less interest means less profit) and increased stock prices as people buy more stocks, more money goes into the market.

As long as interest rates stay low, and investors do not get scared of the economic conditions, more than likely, the stock market will rise. There is nowhere else for the money to go. In this case, money is equivalent to demand. The more money put into stocks, the higher the prices will become.

Anonymous • Apr 27, 2021 at 8:38 am

the photos on your posts are rubbish